For a US-based mobile app client—who we’ve been working with for 5+ years across a combination of digital and what we consider traditional channels (TV, OTT, audio)—we’re analyzing how different variables impact performance.

Our client's goal is to drive sign-ups and track user conversion over six weeks. We measure performance using promo code redemption—an industry standard for gauging direct response campaigns. But, promo codes can be notoriously conservative and underestimate a channel's performance. For example, for this client, for every sign-up tracked via promo code, there’s roughly one additional sign-up that isn’t tied to the code—an estimated underreporting of about 50% of the total impact.). This highlights the need for more comprehensive metrics like geographic incrementality holdout tests and "How did you hear about us" surveys.

The Methodology

Specifically, we looked at three key metrics: how many users signed up, how many completed the key conversion event, and reach/CPM by the end of week six. From this data, and based on historical modeling we’ve conducted with clients, we can reasonably project the number of conversions and the amount of revenue likely to be generated over the course of one to two years.

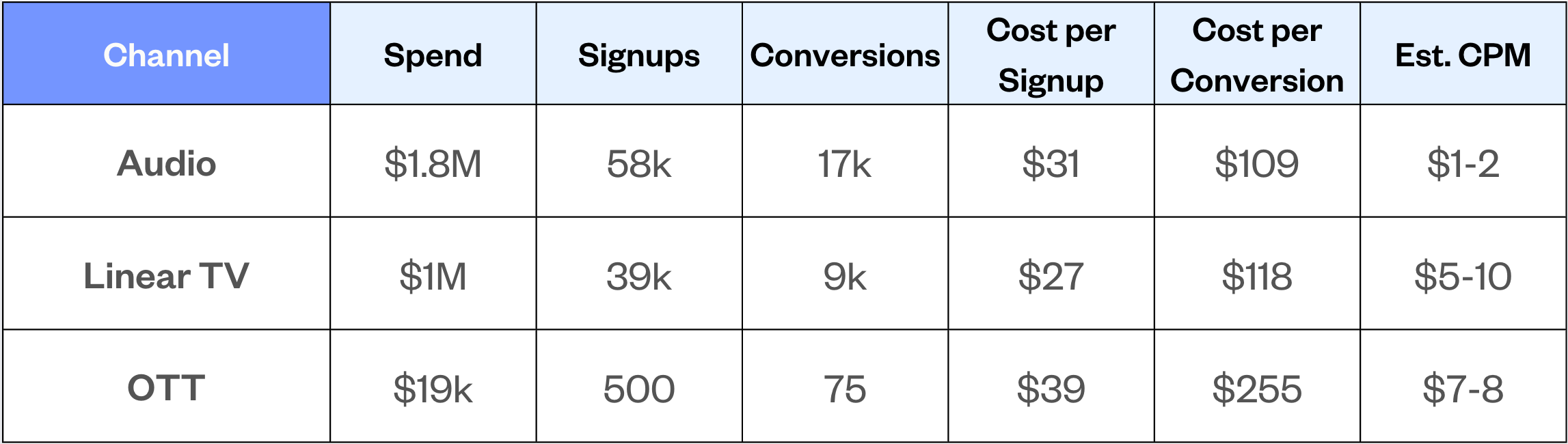

To better understand the performance of the three primary channels they invested in—audio, OTT, and linear TV, we analyzed data from Q4 2024. Here's the unvarnished breakdown of audio, OTT, and linear TV performance.

(This is the first post in a series where we’ll look at the specific tactics that drive success in these channels—channels, spot length, targeting strategies, programming types, time of day, creative approaches, messaging, etc.).

Here’s how the data shook out across key metrics in Q4.

Audio

Our 21-year journey with audio encompasses a strategic mix of spot lengths, dayparts, and geographies, and we're constantly testing creative and messaging. So, we weren’t surprised to see audio as the clear winner in terms of both scale and efficiency. With the best spend-to-conversion ratio across channels, it is a scalable and reliable performer for driving results. Audio’s superior performance showcases its scalability and efficiency.

Linear TV

Linear TV has shown its ability to offer massive reach and conversions. Its broad reach and consistent results make it a valuable strategy component, with opportunities for fine-tuning to maximize efficiency. Developing new creatives to help with back-end conversion is a first line of action. In this case, we’re running ongoing optimizations focused on creative refinement and audience targeting.

OTT/CTV

New to the game in October 2024, it's delivering marginal results, but we're not writing it off—we're optimizing. OTT helps to build brand presence among digital-first audiences, so we see value here, and new creatives are in development to boost conversions.

Final Thoughts

To back these Q4 findings, when we look at the full year (2024) at a glance, the performance of each of these channels reflects that of Q4.

While audio takes the crown for efficiency, the broader story here is about leveraging each channel’s unique strengths. Audio’s unrivaled $1-2 CPM gave us a massive reach from a $2 million spend—an incredible testament to its scalability. Linear TV followed with a $5-10 CPM, offering broad reach and reliable conversions that keep the pipeline steady. OTT, while newer to the mix, showed potential with its $7-8 CPM, carving out a valuable niche among digital-first audiences.

Want more insights like this?

Subscribe to our blog and new newsletter, Growth Decoded, for more growth strategies you'll actually use and the latest performance marketing news.